Bond selling price calculator

Aggregate Bond ETF seeks to provide broad exposure to the US. Conversely when selling below the par value the bond is said to be trading at a discount.

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

Yield to maturity YTM is the total return anticipated on a bond if the bond is held until it matures.

. Start with our bond calculator. Earnings Yield Price Earnings. A fixed-income securitys coupon rate is simply just the annual coupon payments paid by the issuer relative to the bonds.

Selling a house for a profit can boost your finances but the sales process incurs costs along the way. Repairs and maintenance. A coupon rate is the yield paid by a fixed-income security.

The current yield on a AAA rated corporate bond. For more information on the calculators keys and basic functions refer to chapter 2 Getting Started. IShares USD Green Bond ETFs stock was trading at 5426 at the beginning of 2022.

Property Tools. As investor confidence falls they seek more security by selling B-rated bonds and investing in AAA-rated ones. Coupon Rate Annualized Interest Payment Par Value of Bond 100 read more is lower than the YTM the bond price is less than the face value and as such the bond is said to be traded at a discount.

It is not a requirement to be too concerned about the impact of interest rates on a bonds price or market value. The next downside price objective for the bears is closing prices below solid support at the July low of 1801. The bondholder receives the face value of 1000.

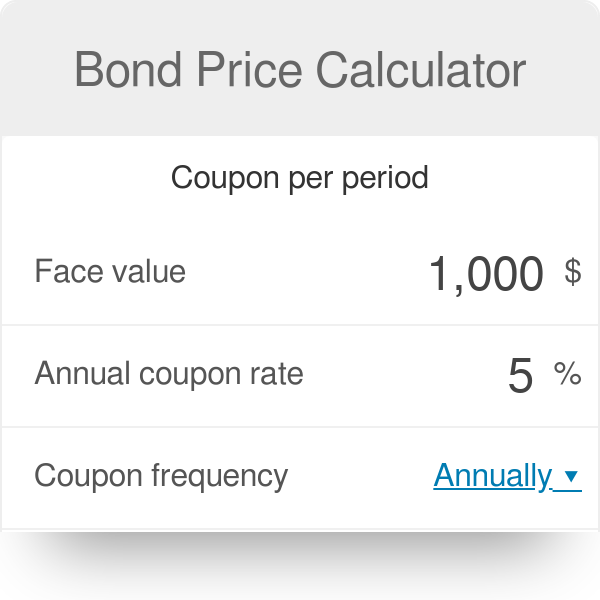

The value or market capitalization of all available BarnBridge in. This bond price calculator estimates the bonds expected selling price by considering its facepar value coupon rate and its compounding frequency and years until maturity. Download Excel based Income Tax Calculator for FY 2020-21 AY 2021-22 incorporating new and existing tax regimeslabs.

Table 1-2 Clearing functions. Figure the Market Value of Bonds. Let us take an example of a bond with semi-annual coupon payments.

A lower yield to maturity will result in a higher bond price. Look for its market price par value and details about coupon payments. This causes the price of the poor.

You will need to input these four factors into the bond calculator to determine your repayment. The Coupon This is simply the interest rate on the bond. View the best growth stocks for 2022 here.

If the current market price is less than the face value then the bond is said to be selling at a discount. This is the price of the home that you are interested in buying. The bond price you get when you plug the 1125 percent interest figure back into the formula is too high indicating that this YTM estimate may be somewhat low.

If you plug the 1125 percent YTM into the formula to solve for P the price you get a price of 92715. The Investment Calculator can help determine one of many different variables concerning investments with a fixed rate of return. There is in depth information on this topic below the tool.

It matures in five years and the face value is 1000. More than 70 percent of the fund is invested in AAA-rated securities. It is called a coupon because originally there would be a paper coupon attached to the bond that the owner would tear off and.

One BarnBridge BOND is currently worth 591 on major cryptocurrency exchanges. Price to Earnings PE. Clears cash flow memory.

You can also exchange one BarnBridge for 000029958 bitcoins on major exchanges. If a company manager has to take decision of buying or selling a stockthen companys relative Graham value RGV has to be calculated and if it isgreater than. P is the price of a bond C is the periodic coupon payment r is the yield to maturity YTM of a bond B is the par value or face value of a bond Y is the number of years to maturity.

Find the margin if the cost is 1500 and selling price is 2200OY Clears break-even memoryOJ Clears TVM memoryO. Price to Book Ratio. Our bond yield calculator will help you calculate the current yield and yield to maturity for a bond.

You can find out which regime suits you Have you Explored all Options to Save Tax for FY 2021-22. Bond and Transfer Calculator. And many investors purchase stocks with the intent of buying them at a low price and selling.

Let us assume a company ABC Ltd has issued a bond having the. The higher the purchase price the higher your monthly repayments will be. Percentages Add 15 to 1750.

Next support is seen at this weeks low of 18605 and then at 1835. Bond price compared to the face value of the bond. Its important to know that most property sells for less than the asking price so you.

In order to calculate bond yields you will need information about the price of the bond and the values of its payments. Suppose a bond is selling for 980 and has an annual coupon rate of 6. First resistance is seen at this weeks high of 19155 and then at 1948.

So we have all of our. The iShares Core US. Then use the ooba Bond Indicator to determine what you can afford.

T Clears statistics memory. Yield to maturity is considered a long-term bond yield but is expressed as an annual rate. Since then BGRN stock has decreased by 130 and is now trading at 4721.

But are worth every penny when considering their expertise and ability to barter a higher price on your home.

Bond Yield Calculator

Excel Formula Bond Valuation Example Exceljet

Bond Pricing Formula How To Calculate Bond Price Examples

How To Calculate Bond Price In Excel

Learn How To Calculate Bond Price Value Tutorial Definition Formula And Example

Bond Yield Formula Calculator Example With Excel Template

An Introduction To Bonds Bond Valuation Bond Pricing

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Bond Pricing Formula How To Calculate Bond Price Examples

How To Calculate The Current Price Of A Bond Youtube

Bond Price Calculator Formula Chart

Zero Coupon Bond Formula And Calculator

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Price Calculator Exploring Finance

How To Calculate Pv Of A Different Bond Type With Excel

Yield To Call Ytc Bond Formula And Calculator Excel Template

How To Calculate Bond Price In Excel